In early 2023, restaurant body National Restaurant Association of India (NRAI) was gung-ho about the Open Network For Digital Commerce (ONDC) and so were other retail associations, but two years later, ONDC does not seem to have moved the needle too much.

The buzz was so loud around ONDC in 2023 that various consumer and payments apps such as Paytm, Magicpin, Ola and others joined ONDC as a buyer app, looking to break into the Swiggy-Zomato duopoly.

But that noise is all but a whimper today. Amid a leadership crisis that has seen CEO stepping down this week after CBO Shireesh Joshi had quit earlier, ONDC is going through a transition. The number of orders reducing significantly since last year, the government backed network is struggling to meet its milestones.

So let’s catch up with ONDC this Sunday and where it is headed. Will the government-backed network fulfil its promise and potential? Before we find out, here’s a look at the top stories from our newsroom this week:

- Once valued at $850 Mn and gearing up for a public listing, Ecom Express has now been acquired by rival Delhivery for just $165 Mn, an 80% value erosion. What went wrong?

- Indian SaaS startups raised over $2.1 Bn in 2024, up 31% YoY. A growing chunk of this capital is flowing toward companies that are not just building on AI, but being built by AI. Behind this investment flurry

- Info Edge-owned Aisle’s revenue soared by nearly 146% in two years and the dating app reduced its cash burn by 42% this year. What exactly turned things around for this Tinder and Bumble rival?

ONDC, backed by the Department for Promotion of Industry and Internal Trade (DPIIT), was introduced in December 2021 and launched for public use in 2023. It was seen as an alternative to the marketplaces and aggregators who were dictating terms for sellers. Instead, the ONDC offered an incentive-based structure for apps and an open network of sellers that everyone on the network could access.

That beginning was great — mammoth on ONDC, almost 50% cheaper than aggregators like Zomato and Swiggy. The social media buzz pegged ONDC as a Zomato and Swiggy killer.

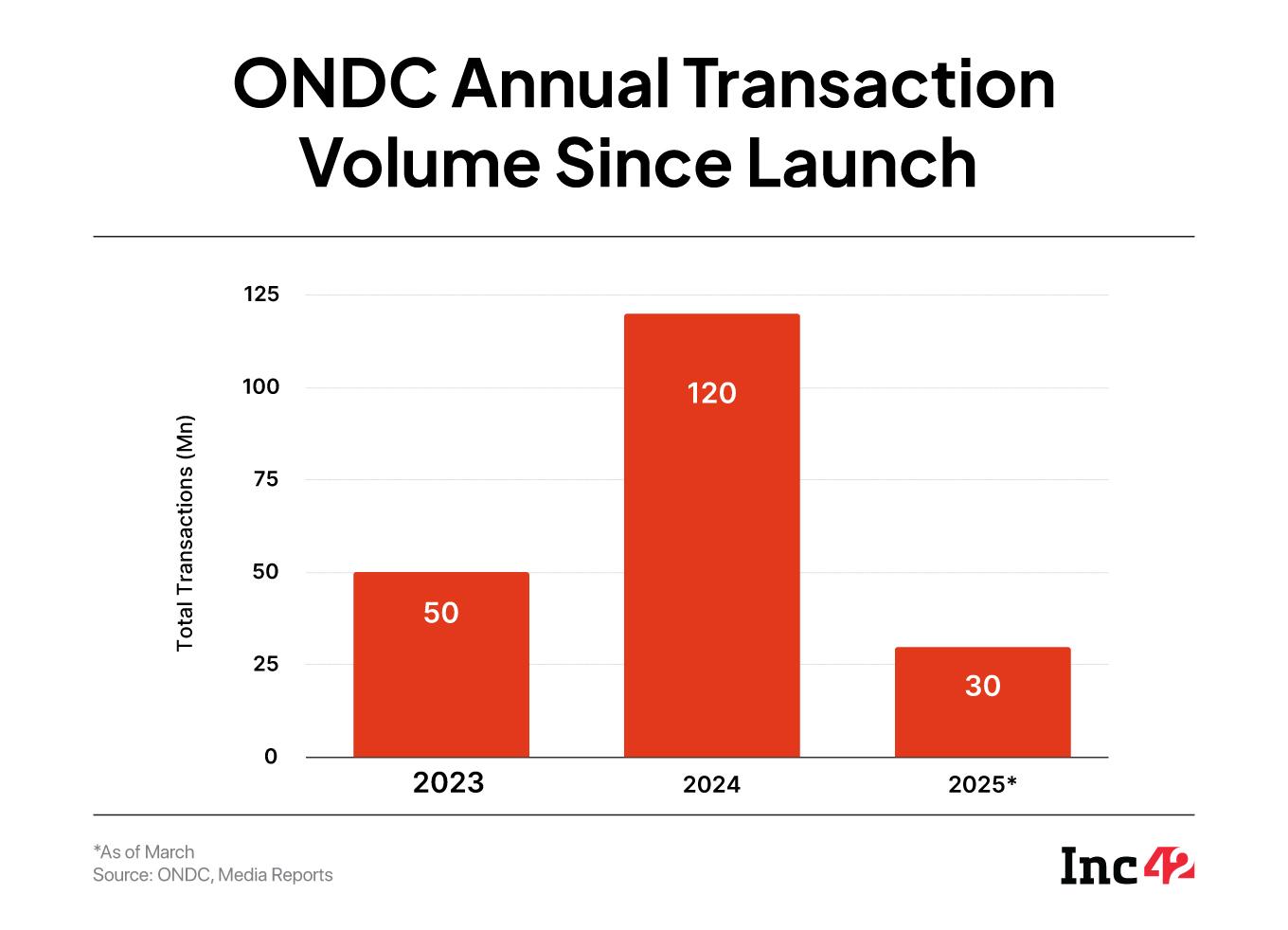

More than two years down the line, today, the network has crossed 200 Mn lifetime transactions as of March 2025 with a significant increase in annual transactions volume, however did ONDC prove to be a Swiggy, Zomato killer or has it been the other way round?

ONDC, which was tipped to be a one-stop shop for all things digital commerce, is now struggling to compete with well-capitalised startups in food delivery and quick commerce segments.

And the resignation of CEO Koshy this month is another blow. Post his exit, an executive committee has been formed to take things forward, with Nitin Nair who heads logistics, mobility, travel segments and Vibhor Jain who is the head of network governance and chief operating officer as key members

“It is a seven member committee which has several vertical heads as members. This executive committee has been tasked with overseeing the operations at ONDC post the exits of the CEO and CBO,” sources told Inc42.

Meanwhile, former CEO Koshy who was also in the founding committee at ONDC, is expected to help with the transition and will be handing over the charge in June 2025.

Inc42 sent detailed queries to ONDC regarding the above developments. The story will be updated as and when the ONDC spokesperson responds.

Behind The CEO ExitSpeaking to Inc42, T Koshy said he believed it was the right time for him to step down as several milestones in transaction volumes, seller onboarding had been achieved.

“If not sizable, we have initiated an idea, set a stage for alternative stakeholders in digital commerce to access wider markets and build products/ services on top of an open source network. This has never happened in India’s digital commerce industry,” Koshy, whose name had become synonymous with ONDC, told us.

While denying any reports on whether ONDC’s transactions, revenue milestones were missed during the last three years, Koshy responded by saying that any transformative idea in a particular industry takes several years to shape and further more time to be accepted broadly.

“The UPI transformation happened over the course of a decade. While the UPI was made open to public in 2016 the idea was conceived several years ago and then many tweaks were done until the fintech industry recognised this digital payment,” Koshy, who served as executive director of National Security Depository Limited (NSDL) prior to joining ONDC, added.

Koshy added that while one may argue on the metrics like market share etc, to compete with deep pockets of giants like Zomato, Swiggy or Zepto continues to be a challenging task.

Did Quick Commerce Craze Doom ONDC?“We did not anticipate in the first year of ONDC being made open to the public that we would cross 50 Mn transactions but we did so. We are anticipating 150 Mn transactions in 2025 alone and by all means this is a huge leap,” Koshy added.

Arguably 2023-24 has been a significant transformative year in India’s ecommerce industry with Zomato’s Blinkit, Swiggy Instamart and Zepto leading a consumer behaviour shift in India. The trio have raised $3.5 Bn in 2024 alone via private funds raise, IPO and qualified institutional placement.

A majority of this capital raise has been deployed to strengthen the capital intensive dark store network, offer cashbacks and expand into new categories, impacting not only ecommerce giants like Amazon, Flipkart but India’s mammoth $1 Tn retail industry which includes scores of kirana stores and small shops.

also became a casualty of the quick commerce advent with a foreseeable slump in retail orders towards the latter part of 2024 and first three months of 2025.

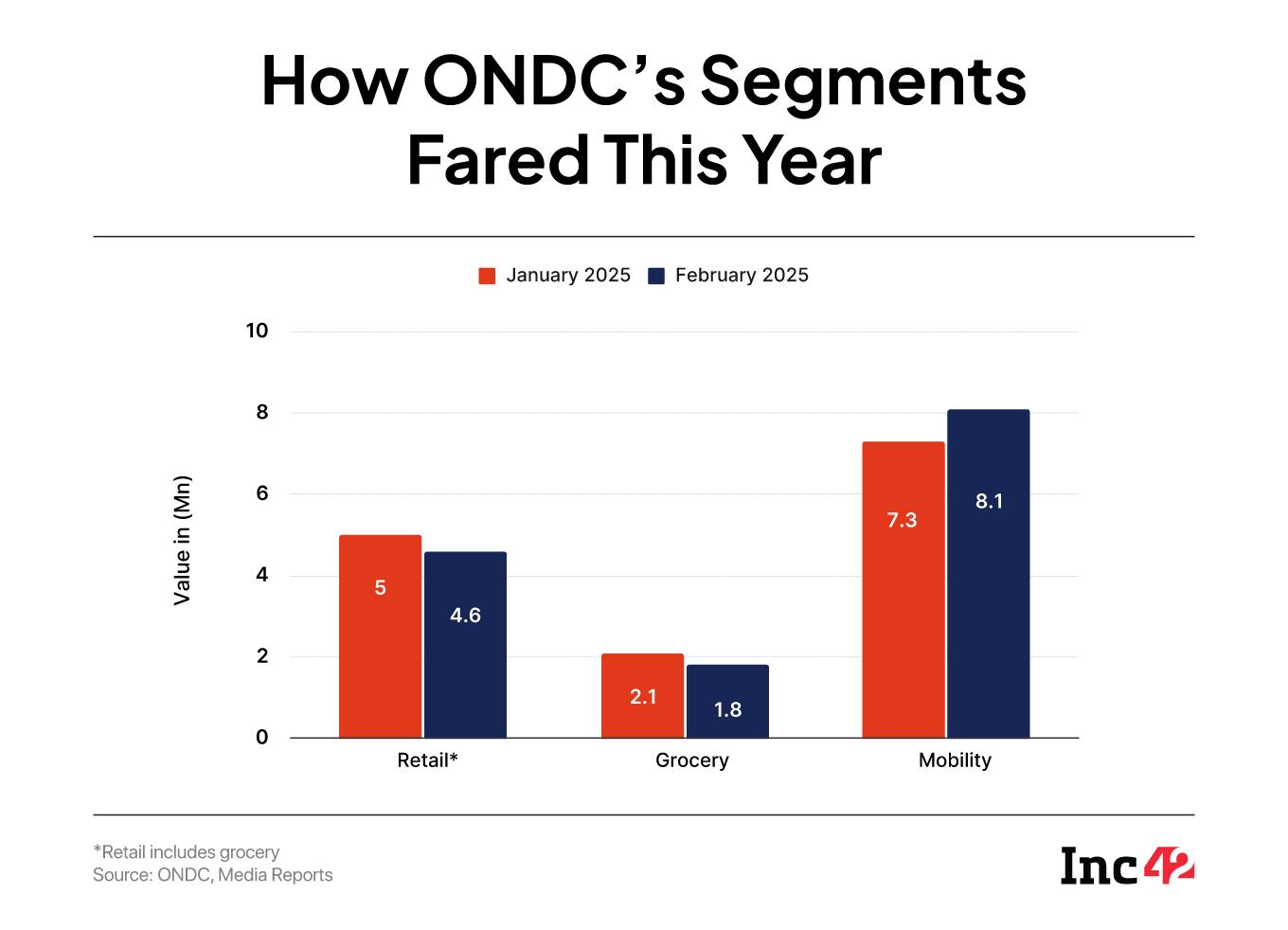

Retail transactions which include food deliveries, fashion, electronics and groceries have consistently fallen, peaking at 6.5 Mn per month in October 2024 but declining to 4.6 Mn in February 2025 marking a 10-month low.

In the retail segment, the grocery reportedly constituted 1.8 Mn monthly transactions in February 2025 — a paltry number by most comparisons in the grocery space. Sources said that the share of grocery has consistently shrunk in the overall retail order volumes on ONDC whereas food delivery volumes have seen flat growth from the peak of 2024.

“Zepto single handedly changed the narrative of digital retail delivery and consumption by expanding faster and raising mega funds raises in the first half of 2024. Blinkit and Swiggy Instamart have not held back and targeted the markets quickly capturing almost 90% of the industry. When it started, ONDC was reporting better than expected numbers due to seasonal peak demand in the festive season. After that, it has been a sob story for ONDC retail segment with consistently falling retail transactions,” a source within ONDC added.

Meanwhile, Koshy believes that the idea was not to challenge these large players as competing with flush ecommerce giants is a herculean task. He said that ONDC wanted to prove that an alternative can exist for India’s digital commerce industry.

“If you think about it, this is akin to what happened in the financial services and other industries. Some sort of consolidation will be there but that does not mean there should be no market competitiveness,” Koshy added.

On the other hand ONDC’s founding members that includes Protean eGov Technologies Limited and Quality Council of India and other shareholders like ICICI Bank, Bank of Baroda, Avaana Capital, HUL among others decided to scale down the incentive programme launched at the outset to attract buyers and sellers.

In addition, the buyer side applications like Paytm, Magicpin, Ola and others have also reduced the discounts they were offering to the consumers for retail orders placed via ONDC network. Is ONDC fading away as a result?

Shrinking Discounts Play SpoilsportDespite being just a year old in 2024, ONDC started a strategic shift and cut down incentives offered to network participants from the peak of INR 3 Cr in July 2024 per participant, to INR 30 Lakh in December 2024 per participant if sellers averaged 1 Mn monthly orders.

In addition, the network began charging INR 1.50 transaction fees for any transaction above INR 250 from the seller in a move underscoring ONDC’s thrust on maintaining financial stability and operational sustainability.

On the other hand, the buyer-side apps have also significantly reduced the discounts being offered on grocery, food delivery orders which includes players like Paytm, Ola and Magicpin. The operational costs were being supported by the incentives offered by the network shareholders but with that significantly down, buyer apps are finding it increasingly difficult to compete with quick commerce companies.

“PhonePe’s Pincode also opted out of ONDC primarily due to this reason. While the buyer side apps were offering discounts to the buyer, they were not charging high enough commissions from sellers which almost made it difficult for them to sustain,” a senior executive with ONDC associated buyer-app told us requesting not be named.

An ecommerce player which onboards sellers on ONDC stated that in comparison to Swiggy, Zomato which charged restaurants 30%-40% commissions, ONDC’s buyer apps like Paytm, Ola or even Magicpin took a mere 5% commission and have stuck to this low rate despite food delivery seeing an overall slump.

The Silver Lining For ONDC“Even Zomato, Swiggy’s food delivery business has slowed down. But they have been able to post healthy margins due to higher commissions from restaurant partners and other charges being levied on the platform passed on to consumers. For ONDC this proved to be deadly with overall industry slowing and discounts disappearing,” the above person stated.

Despite retail orders slowdown, mobility and logistics segments have held onto strong transaction volumes and surprisingly performed better than retail.

“Mobility overall is undergoing a rapid shift with Ola, Uber’s dominance withering, Rapido taking over and BluSmart in deep crisis. Namma Yatri which was the first mobility player to onboard ONDC paved the way for zero commission rides which was trend setting for the industry. ONDC in that sense has a first mover advantage and has done good so far,” an ecommerce sector analyst said.

Koshy told us that in addition to ride hailing services, ONDC has been able to rope in various city metros, bus services to facilitate the mobility segment business.

“The mobility segment is now active in three metros and 18 cities. We started mobility services in Bhubaneswar and expanded later on. We are now collaborating with Delhi Transport Corporation (DTC) for online sale of DTC bus tickets. Besides, we have made bus bookings available via Redbus,” Koshy added.

The other success story of ONDC seems to be from the logistics industry with the network now onboarding multiple large and small players which include Delhivery, Shadowfax, Loadshare, Ola, Porter, Amazon Logistics, Ekart among others. The logistics orders increased from 35,000 in April 2024 to 2 Mn in February 2025.

“Logistics is perhaps the most important success story to have come out of ONDC so far with a huge gap being filled by logistics players onboarding ONDC and sellers now being given the choice to choose anyone among these players for running their deliveries,” founder of a key logistics company which is working with ONDC told us.

Despite the initial hiccups ONDC has made some strides in the digital commerce but will likely bank on a more financially sustainable model as well as generate heightened consumer awareness in order to give the rivals some competition. As of now, the immediate challenge will be to overcome the leadership crisis and ensure the smooth operations.

“ONDC is here to stay. It is a process in making. Today we have the likes of Reliance, Tata Group and Bajaj joining us besides numerous new age companies from each vertical. We have set the stage and someone will have to take it to the next level,” former CEO Koshy added.

But food delivery and grocery shopping are the most frequent use-cases that ONDC was looking to unlock and gain some advantage over delivery apps and marketplaces. Will the entry of conglomerates and new-age giants force it into a new direction and take it off the public limelight?

Sunday Roundup: Startup Funding, Deals & More- Digital transactions were impacted today due to a widespread outage on the UPI network — the sixth such outage in the past year — with several users reporting failed transactions and payments

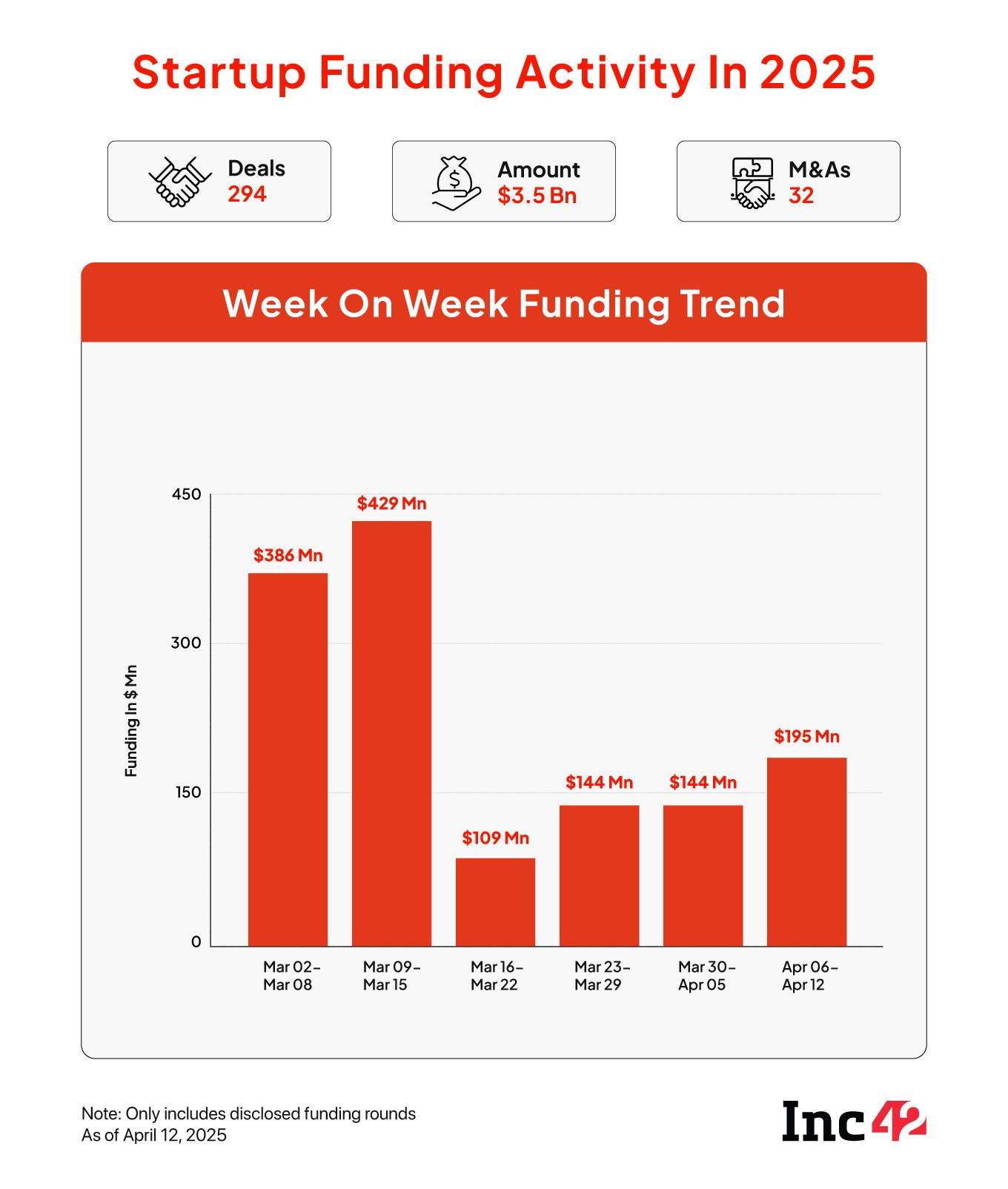

- Between April 7 and 12, Indian startups cumulatively raised $195.1 Mn across 20 deals, marking a 35% surge from the previous week

- EV major Ola Electric has launched its first Roadster X motorcycle from its Futurefactory, the model which the company had accounted for in its February sales data

- Amid the ongoing global AI race, India must focus on building a ‘sovereign AI’ ecosystem to ensure autonomy over its data, Sarvam AI cofounder Vivek Raghavan said at the GenAI Summit By Inc42 this week

Edited by Nikhil Subramaniam

The post appeared first on .

You may also like

Panel turns down road ministry proposal for 2 tunnels in Jammu & Kashmir

Ruben Amorim pulls no punches with damning Man Utd verdict - "We have to accept that"

'I drove a car for the first time in years and 1 thing was completely unexpected'

Upstairs, Downstairs star Jean Marsh dead at 90 as fans pay tribute

The incredible new £380m highway that links African capital city to major airport