In 2014, Manu Chandra made what he describes as the riskiest investment decision of his life — he poured money into fledgling yoghurt brand Epigamia.

The startup behind the brand had no institutional backing, no promise of returns, and Chandra’s decision was purely guided by gut instinct and a belief in India’s rising consumption story. More than a decade later, India’s consumer story has not just held up to this faith — it has grown exponentially.

That early bet set in motion the journey that would culminate in Sauce.vc, one of the most focussed early-stage investors in the Indian consumer brand landscape today.

India is now widely considered the fastest-growing domestic consumption market globally, and this growth is being driven not by legacy players alone, but by a new cohort of digital-first, niche, and purpose-led brands.

This growth is shaped by rising digital access, new consumption habits, and a wave of startups building internet-first brands. According to , beauty and personal care, food and beverage, and fashion are the three largest categories in the D2C ecosystem. For instance, beauty and personal care brands made up 28.6% of pool of applicants for the FAST42 list, followed by food and beverage at 27% and fashion at 25%.

This shift has been mirrored by capital flows. Since 2021, over $5.7 Bn has been invested across 640+ deals in India’s D2C startups, according to Inc42 data. Several venture capital firms have emerged with specialised consumer investment strategies, with Sauce.VC among the early movers.

Based in Delhi NCR, Sauce.vc focusses on pre-seed, pre-revenue businesses, backing them early and working closely with founders through the critical zero-to-one journey. Backing these brands—often before they even have revenue—is what Sauce.vc has built its playbook around.

Chandra told Inc42 that Sauce.vc was launched with a sharp and well-defined thesis: invest early — even as early as pre-revenue — into emerging consumer brands, and stay close to founders, not just with capital but operational support.

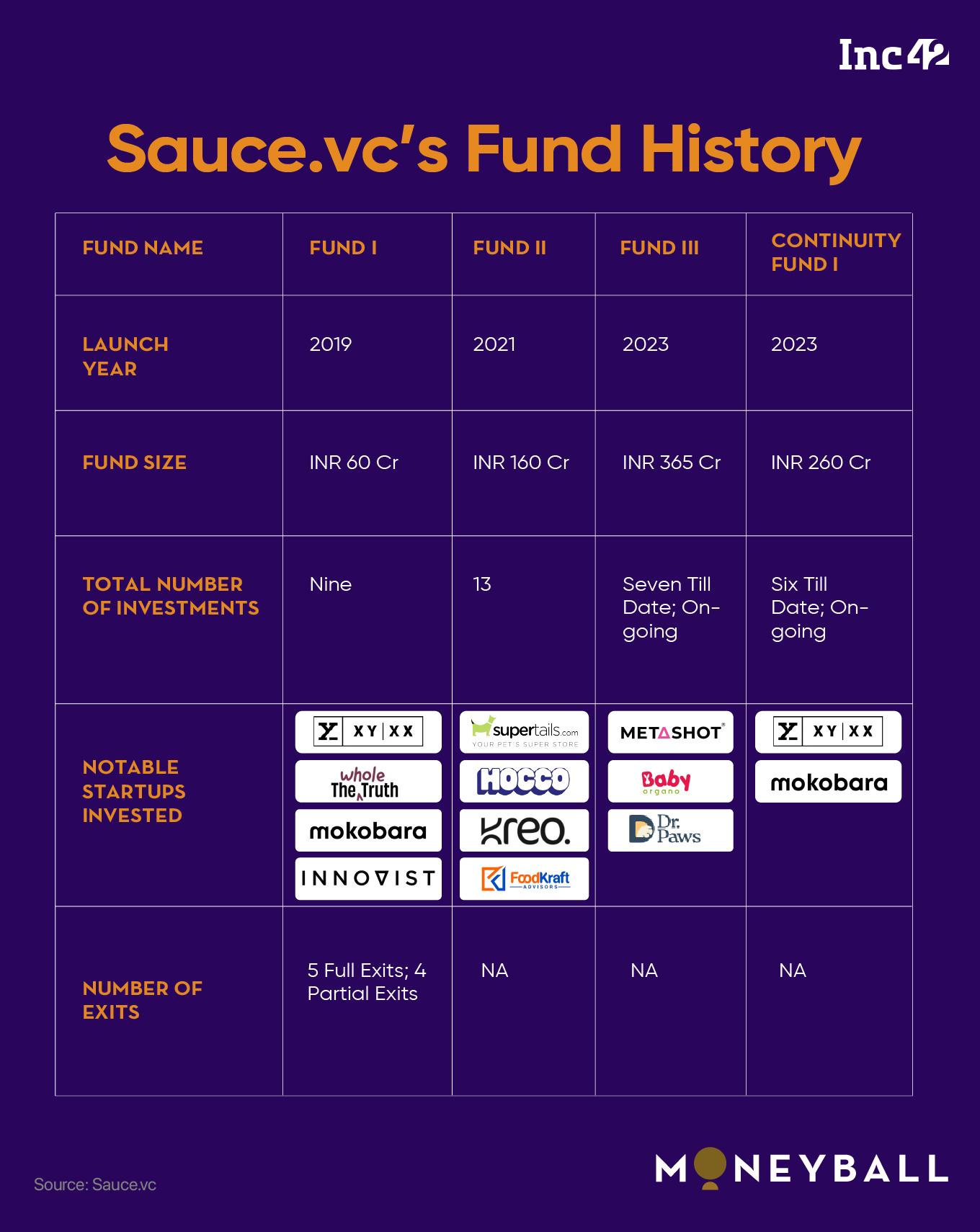

The firm’s maiden fund was modest by any metric. With a corpus of INR 60 Cr, it was deliberately small, allowing Chandra and his team to test their investment hypothesis without overextending.

It was also intensely personal, the founder said, with INR 10 Cr coming from Chandra himself as a principal contribution. “It was either buy a house or build this fund,” he recalled, adding, “I chose the latter.”

The strategy was high risk: a concentrated portfolio of just a few companies, many of them at idea or prototype stage. Five investments didn’t work out. But four did, and exceptionally well at that.

Sauce.vc’s investments in Mokobara, XYXX, The Whole Truth, and Innovist (the parent company of Bare Anatomy, Chemist at Play, and SunScoop) now accounts for 75% of the first fund’s invested capital.

The Sauce.vc Thesis And PlaybookThe 2019 vintage fund is currently tracking a 70% IRR and a 10x MOIC, with nearly 2x returned to LPs already. “This might end up being one of the best performing early-stage funds in India,” Chandra says.

High conviction, deep concentration, rigorous diligence, and operational proximity are key pillars of Sauce.vc playbook, the founder said in an in-depth interview with Inc42.

What distinguishes Sauce.vc, according to him, is not just early entry but the concentration of bets. He also believes that the key to high returns in the VC business lies in identifying the few winners and doubling down.

“If you don’t know what’s going on in your portfolio, you’ll end up spreading too thin. We try to go deep into a few companies we really believe in.”

This strategy bore fruit with Innovist.

Initially a personalised shampoo startup, it pivoted into a portfolio of science-led, off-the-shelf personal care brands. That pivot, guided closely by Sauce, turned a struggling startup into one of the fastest-growing digital-first beauty companies in the country. Today, Innovist has reached INR 500 Cr in revenue scale and is cash-flow positive.

Chandra explained, “There is always some sort of gap on that. At the premium end of the market, you’re able to circumvent that through smart business models, category expansion, and digital-first strategies.”

Similarly, Sauce backed luggage brand Mokobara despite 31 rejections from other VCs at the Series B stage. The team stayed the course, eventually helping the company scale with resilience and precision.

“We’re not just investors. We sit with the founders to figure out pivots, distribution strategies, team gaps, everything,” Chandra added.

Next, in a market where some high-profile startups have faced scrutiny over financial practices, Sauce.vc has taken a unique approach to due diligence. Rather than relying solely on initial documentation, they maintain a deep, ongoing involvement with portfolio companies.

“Due diligence is not just a one-time event for us. You have to be an active investor. You have to be very close to the founder and the team. You have to have access to data on a regular basis. That’s the only way to triangulate and spot red flags early,” he claimed.

By maintaining strong oversight on cash flows, related-party transactions, and real-time performance metrics, Sauce mitigates risks that even global investors sometimes miss. Keeping one’s ear close to the ground and “being in the trenches” helps investors validate founder intent.

The Shift To A Multi-Fund StrategyAfter getting plenty of validation about its thesis from Fund I, Sauce.vc launched Fund II in late 2021, raising INR 160 Cr at a time when the market was frothy and valuations were overheated. But instead of rushing to deploy, the team waited for the cycle to correct.

From Fund II, one of Sauce.vc’s biggest bets is Hocco Ice Creams, launched by the , the business behind another legacy ice cream brand.

In just a year, Hocco hit revenue targets originally set for its third year. Sauce entered at the pre-revenue stage and is currently the sole investor alongside the founders. The brand is on track to hit INR 800–1000 Cr in net sales in year three.

Other bets from the second fund include Supertails in pet care, Kreo in gaming accessories, Foodcraft, a mass-market staples brand that closed last year with INR 500 Cr in revenue and profitability.

Chandra said the second fund is already tracking a 2.5x MOIC and 60% IRR, which he says is remarkable for a fund still early in its lifecycle. Although there have been no exits yet, the signals are strong.

And these signals have given more conviction to Chandra and Sauce.vc’s team. In 2025, the firm floated plans for a third fund, which was after being oversubscribed 3x within weeks. The number of limited partners were downsized to maintain investment discipline, and to ensure Sauce could continue deploying capital in a concentrated, high-conviction manner.

“The discipline on size is critical. Just because someone offers you INR 1,000 Cr doesn’t mean you should take it,” Chandra emphasises. “This business is about trust, and consistency is more important than scale.”

Structuring For Continuity: Opportunity FundsHowever, across the funds, the strategy hasn’t changed. Cheque sizes have grown from INR 1 Cr in Fund I to INR 4–5 Cr in Fund III but the core playbook remains intact, which comes down to 12-15 pre-seed bets, sharp sectoral focus, and deep involvement.

One key early learning for Chandra and Sauce was balancing the different time horizons of founders and LPs. Founders want decade-long partnerships, whereas LPs expect returns in 6–7 years and Sauce’s solution to this dilemma was a dual-fund model.

The 10-member Sauce.vc team now runs small early-stage funds for new bets, and separately raises larger “opportunity funds” to double down on winners from earlier funds.

In 2023, Sauce raised its first continuity fund of INR 260 Cr to invest in six breakout companies including XYXX and Supertails. This fund currently tracking a 94% IRR and a 2.5x MOIC within two years.

A second continuity fund was launched in early 2025 — with INR 700 Cr targeted and INR 250 Cr in commitments from domestic LPs. This fund will be deployed for follow-on rounds in profitable, cash-flow-positive category leaders where Sauce already holds meaningful equity.

According to Chandra, India’s consumer brand evolution is just beginning. There’s been a visible shift in both founder quality and market readiness. Many founders today are second-timers or ex-operators from successful brands, bringing sharper execution and ambition.

Capital, meanwhile, is abundant. What founders increasingly seek is value-add capital, or partners who understand brand building and customer insight, not just spreadsheets.

“The quality of founders has improved. They’re more ambitious and more selective. Capital has become a commodity. What they want is a value-add investor,” Chandra told us.

That has allowed Sauce to win deals even when others offer more money.

On the demand side, the premium end of India’s consumption story is expanding rapidly. With digital-first Gen Z consumers leading the charge, even premium categories like skincare, personal care, health foods, and pet care are seeing explosive growth.

Chandra sees room for multiple INR 500 Cr brands rather than standalone INR 2,000 Cr mega-brands. Unlike many funds chasing trends, his bet is on fundamental consumer evolution because he sees multiple niche brands scaling rapidly in India.

Even without playbooks, every category will be premiumised, and investors will look to back the brands rewriting the rules in that niche.

AI, Digital Natives, And The Future Of Shopping“The market is fragmenting, and consumer loyalty is lower. The real play is to build category-focussed, multi-brand portfolios that stay relevant,” he added.

Like most other venture capital players, Sauce.vc is also embracing generative AI to drive both internal efficiencies and portfolio growth. The team for instance uses AI tools and applications for diligence, founder calls, and even marketing content evaluation.

It’s a known fact that GenAI is quietly powering the next wave of efficiency in content creation and consumer targeting. Sauce has already seen campaigns in its portfolio brands being designed, tested, and optimised using AI-based tools — especially for hyper-personalised storytelling and regional targeting.

“You can create 30 different ad creatives for different regions or audiences in minutes. That’s a game-changer,” Chandra noted.

At the same time, digital commerce is becoming more entrenched. For affluent, urban Gen Z consumers, platforms like Amazon, Blinkit, and Instagram are default shopping destinations. “My kids have never been to a kirana store. Everything is online. That behaviour is sticky.”

This shift allows brands to launch and scale without traditional distribution muscle. Capital efficiency is improving, and so is the ability to build direct customer relationships from day one.

Sauce.vc is now six years and five funds into its journey. While the track record is attracting attention, Chandra knows that the approach needs to remain rooted in consistency and strategic restraint. It’s not about raising a mega corpus or chasing fads. The bet is placed on consumer insight, founder quality, and long-term brand building.

The post appeared first on .

You may also like

"Rahul Gandhi has been continuously batting for caste census": Congress leader KC Venugopal

Thunderbolts* spoilers review: Marvel's sidekick Suicide Squad is a snooze-fest

Doomed skydiver's mysterious final days from flurry of jumps to 'deliberate act'

Lorraine Kelly corrected by Kevin McCloud in awkward moment

Amal Clooney faces US ban from Donald Trump after major Foreign Office caution