Swiggy’s Q1 FY26 numbers served up a familiar dish from India’s foodtech kitchen – sizzling growth but with bloated losses. The company’s operating revenue surged 54% YoY to INR 4,961 Cr while net losses nearly doubled YoY to INR 1,197 Cr due to aggressive quick commerce expansion.

Here are the key takeaways from Swiggy’s Q1 FY26 numbers:

- Adjusted EBITDA loss rose 75% YoY to INR 813 Cr

- Total income zoomed 53% YoY to INR 5,048 Cr

- Expenses rose 60% YoY to INR 6,244 Cr from INR 3,908 Cr

- Monthly transacting users grew 32.5% YoY to 2.2 Cr

- The foodtech major’s B2C orders rose 24% YoY to 2.6 Cr

The Quick Commerce Conundrum: Instamart remained Swiggy’s biggest growth engine and cash burner. The quick commerce arm generated INR 806 Cr in revenue (up over 2X YoY) while posting a staggering INR 797 Cr loss, nearly 3X YoY. It added 41 new dark stores during the quarter.

Swiggy’s Key Revenue Cogs: Swiggy’s core food delivery business remained a pillar of stability, clocking INR 1,800 Cr in revenues to fetch a profit of INR 202 Cr, up 200% YoY. Surprisingly, supply chain and distribution remained the biggest source of revenue, raking in INR 2,259 Cr (up 78% YoY) with a slightly increased loss of INR 47 Cr from INR 43 Cr in the year-ago quarter.

But, What About Profitability? CEO Sriharsha Majety believes that the days of peak losses due to quick commerce burn are behind the company. Going forward, he assures that the foodtech major will add dark stores only to alleviate capacity constraints, while “modulating investments” to help the company move towards scale and profitability.

Amid this, the foodtech major is mulling a stake sale in ride-hailing giant Rapido, which also plans to enter the food delivery space.

With another rival (Rapido) on the prowl, can Swiggy’s growth-first strategy eventually translate into sustainable profits? While you ponder, here is how the foodtech major fared in Q1 FY26.

From The Editor’s DeskIs Opinion Trading Dead? Probo and other opinion trading apps surged during IPL 2024, letting users bet on real-world outcomes like sports and elections. These platforms now face legal heat, with ED raids and multiple state-level FIRs and PILs challenging their legality.

PB Fintech’s Q1 Snapshot: The fintech major’s consolidated net profit zoomed 41% to INR 84.7 Cr in Q1 FY26 from INR 60 Cr in the year-ago quarter. However, it slipped 50% from INR 170.7 Cr in the preceding March quarter. Operating revenue rose 34% YoY to INR 1,348 Cr.

Safe Security Mops Up $70 Mn: The enterprise cybersecurity startup has raised the funds as part of its Series C funding round led by Avataar Venture Partners. Founded in 2012, Safe Security offers AI-driven, real-time solutions for managing and mitigating cyber risk.

B’luru Techie Held In CoinDCX Heist: Bengaluru police have arrested a software engineer at CoinDCX after hackers allegedly used his login credentials to exploit confidential financial processes. The accused has denied any involvement but admitted to engaging in moonlighting.

Another Startup Shuts Shop: Founded in 2022, Plus Gold has ceased its operations due to an inability to secure capital. Plus Gold operated a full-stack platform designed to make gold savings and investments more accessible.

TVS Wins The EV Race: Automotive majors TVS Motor and Bajaj Auto continued to dominate electric vehicle two-wheeler registrations in July, holding on to their leading positions in the segment. However, both companies experienced nearly an 18% month-on-month decline.

Inflection Point’s $110 Mn Fund: The angel investing firm has launched IPV International, an angel fund registered under GIFT City’s IFSCA framework. The sector-agnostic fund will invest in early to Pre-Series A stage startups, with ticket sizes ranging from $100K to $1 Mn.

Metaforms Nets $9 Mn: The B2B AI market research startup has raised the capital in its Series A round led by Peak XV Partners, with participation from Nexus Venture Partners and Together Fund. Metaforms leverages AI to help market research agencies automate daily tasks.

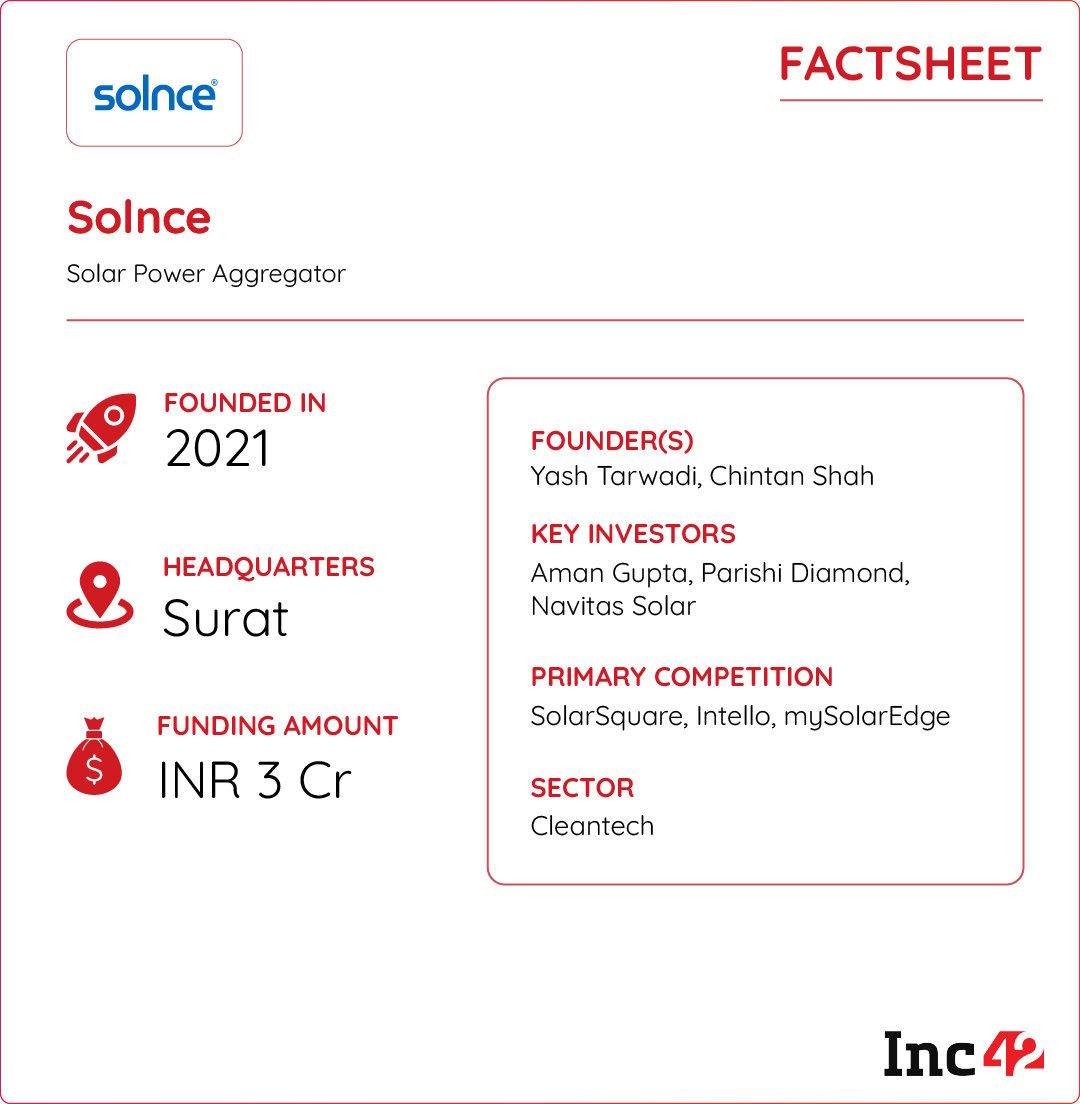

Inc42 Startup Spotlight Can Solnce Spark A Solar Power Revolution Among Indian MSMEs?India’s 300 GW solar dream by 2030 hinges on the widespread adoption of solar energy.

Despite this, MSMEs, which drive 30% of the GDP and account for 10–15% of industrial emissions, struggle to leverage the sun due to high costs, policy hurdles and fragmented supply chains.

Despite their willingness, these businesses often lack clarity on pricing, subsidies, and compliance, with most government incentives skewed toward residential users.

A Shining Solution: Solnce operates as a solar aggregator with dual apps for consumers and businesses. It links MSMEs and households to vetted EPC partners, manages subsidies, permissions and post-installation support, and delivers transparent pricing.

Harvesting Success: With over 6 Cr registered MSMEs spending a significant slice of operating income on electricity, the addressable market is vast. Leveraging this, Solnce’s asset-light model has driven profitability (INR 40 Cr revenue in FY25), and it is adding carbon-credit facilitation while targeting INR 100 Cr in revenue for FY26. Can Solnce spark a solar power revolution among Indian MSMEs?

The post Swiggy’s Q1 Report Card, Safe Security Nets $70 Mn & More appeared first on Inc42 Media.

You may also like

Mumbai News: Christian Groups Condemn Arrest Of Kerala Nuns In Chhattisgarh Over Alleged Trafficking And Conversion

Punjab & Haryana HC Dismisses Kangana Ranaut's Plea To Quash Defamation Case

5th Test: Siraj And Prasidh Pick Three Wickets Each To Lead India's Fightback, Leave England At 215/7

Vasai-Virar Illegal Construction Scam: ED Reveals ₹35/Sq Ft Bribes For Building Approvals, Ex-Commissioner Under Probe

Bhopal: Another Rape Case Against DJ Yaseen; Raped On The Pretext Of Marriage