It seems there is no stopping India’s quick commerce giants. After groceries and gadgets, they have now set their sights on the most complex category yet – 10-minute medicine deliveries. So, what’s their game plan for the regulated and tricky waters of pharmacies?

Chasing The High: To each their own seems to be the mantra of quick commerce giants wading into medicine deliveries. Instamart is banking on its commission model with PharmEasy to make a dent, while Zepto and Blinkit’s playbook involves controlling the entire supply chain to deliver in under 10 minutes.

A Prescription For Profit? The quick commerce trio is chasing drugs for a good reason. With average order values exceeding INR 1,000, compared to INR 600 for groceries, medicines offer high margins that these companies desperately need for profitability. But unlocking this margin will not be easy.

The Acquisition Dose: Firstly, margins come from owning inventory. This means Zepto, Blinkit, and Instamart will likely have to acquire pharmacy chains to gain licensed premises and qualified staff. But unlike shutting down unprofitable dark stores, exiting pharma locations means writing off significant upfront setup and regulatory costs.

Chained By Compliance: Unlike grocery, pharma delivery operates in a heavily regulated environment that doesn’t bend to startup timelines. It requires specific licences for every state and location, specialised hiring and continuous compliance. This is also a challenge that quick commerce companies have never dealt with before.

Trust Gaps: There are other operational complexities as well, such as cold storage and warehousing norms in prescription medicines. Then there is the foundational issue of trust, where 10-minute delivery platforms don’t have a great track record.

Even established players like Tata 1mg and Netmeds haven’t rushed into 10-minute deliveries, suggesting the challenges run deeper than quick commerce platforms anticipate.

All of this makes us ponder —can the promise of speed really survive the weight of regulation and trust deficits in pharma? Let’s find out…

From The Editor’s DeskThe Great Indian RMG Reset: Since the Centre effectively put an end to the RMG chapter with its blanket ban on real-money gaming, industry players are pivoting to newer areas such as free-to-play social games, microdrama and investment tech. Will they find success?

Startup Funding Rebounds: Indian startups cumulatively bagged $98.2 Mn across 18 deals last week, up 58% from the $62.2 Mn raised in the preceding week. TransBnk and Altum Credo led the charts by taking home $25 Mn and $19.4 Mn, respectively.

New-Age Tech Stocks Bleed: Twenty-seven of the 37 new-age tech stocks under Inc42’s coverage ended last week in the red. While TBO Tek and PB Fintech emerged as the biggest losers, Menhood and Ola Electric were the biggest gainers.

LEAP India Files DRHP: The supply chain solutions provider has filed its draft papers with the SEBI to raise up to INR 2,400 Cr via its market debut. Its public issue will comprise a fresh issue of shares worth INR 400 Cr and an OFS component of INR 2,000 Cr.

General Catalyst’s Partner Quits: Priya Mohan has stepped down from her role at the VC firm to take a career break. She joined General Catalyst in June 2024 after the investment firm announced its merger with Venture Highway. Mohan served as the MD at Venture Highway.

PB Fintech All Set For Merger: The NCLAT has approved the merger of Info Edge’s subsidiary Makesense Technologies with the fintech major. Upon amalgamation, shareholders of Makesense will be issued a 13.04% stake in PB Fintech.

Dream11’s FanCode Bet: India’s $12 Bn RMG ecosystem was obliterated overnight last week. Amid the chaos, Dream11 found its salvation in an unlikely saviour — FanCode, the sports streaming platform it once considered a sidekick.

Tracking FY25 Startup Financials: Forty-six startups cumulatively posted INR 1.35 Lakh Cr in revenues in FY25, up 46.4% from INR 92,579.8 Cr in FY24. While 16 reported a cumulative net loss of INR 8186 Cr, the remaining clocked a cumulative profit of INR 4,865.82 Cr.

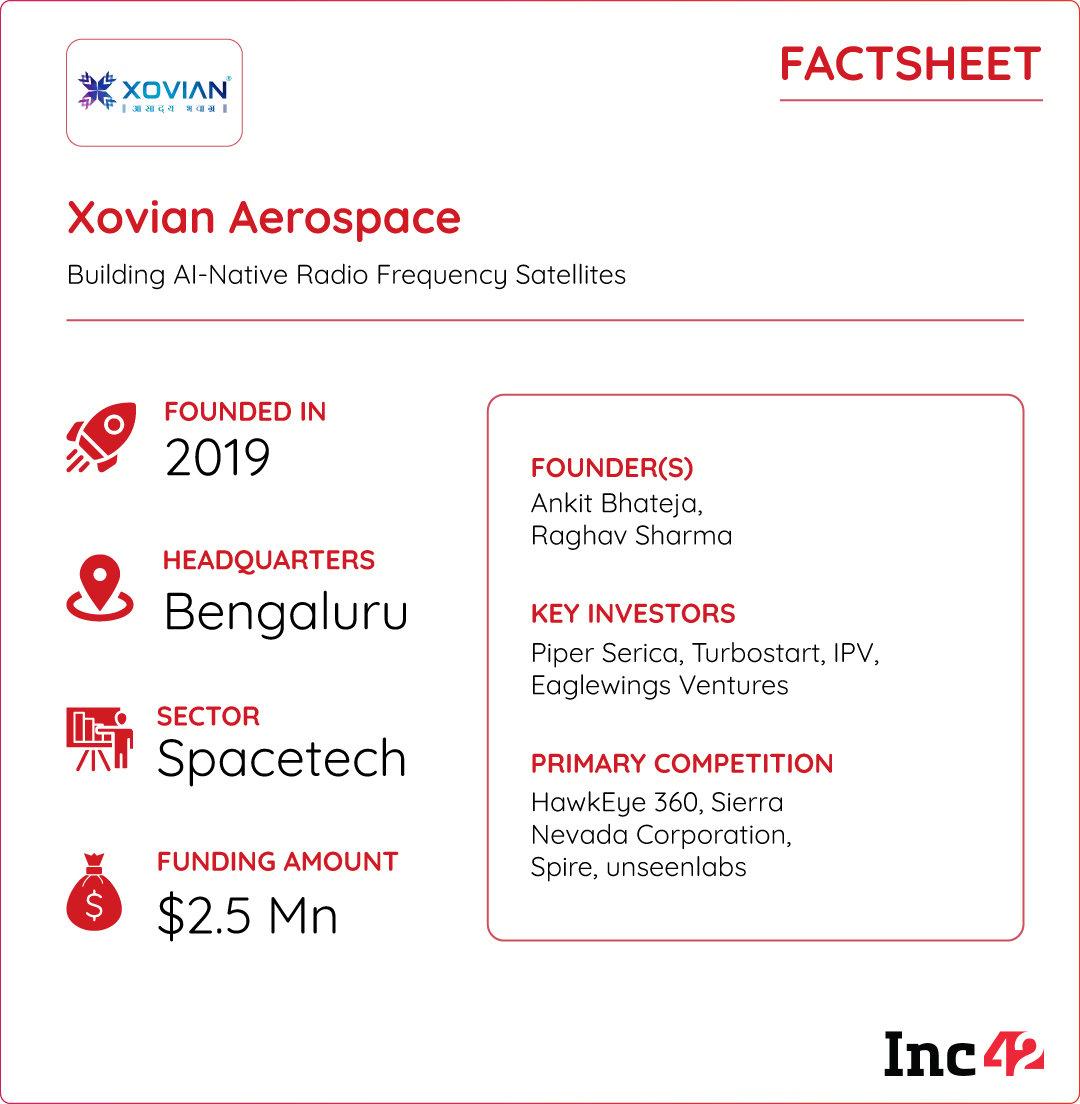

Inc42 Startup Spotlight Can Xovian’s “SOS” Tech Track Ships From Space?Tracking a lost aircraft or vessel in remote areas can be a difficult task as traditional satellite imaging often falls short when assets go off the radar. Xovian Aerospace is solving this problem by replacing traditional satellite cameras with radio frequency sensors.

From Signals To Insights: Xovian’s approach involves a fundamental rethink of satellite payload design. Instead of relying on optical imaging, low-earth orbit (LEO) satellites can carry RF sensors to detect and track RF signals from assets anywhere on Earth. The startup is also developing a data intelligence platform that converts these RF signals into actionable insights for clients.

Six Years In The Making: Xovian has spent the past half a decade perfecting its payload technology and is now finalising satellite design, payload systems, and software architecture. The startup has successfully ground-tested its satellite payload and is planning a pilot launch by Q4 next year.

Positioning For Success: Backed by Piper Serica and Turbostart, along with cloud infrastructure support from Amazon, the startup is looking to capture a big pie of the Indian spacetech sector, which is projected to become a $77 Bn opportunity by 2030.

As the deeptech startup prepares for its maiden launch, can Xovian’s novel RF approach to imaging find takers globally?

The post The Quick Pharma Race, What’s Next For RMG Founders & More appeared first on Inc42 Media.

You may also like

Driver Arrested After Crashing Into Russian Consulate in Sydney

Modi's Visit to China: Strengthening Ties at the SCO Summit

Severe Weather Alert: Heavy Rain and Hail Expected in Uttarakhand and Uttar Pradesh

Rahul Gandhi's 'Voter Adhikar Yatra' will conclude in Patna today

Afghanistan earthquake: At least 20 killed and over 100 injured in 6.0 mag quake